Business Credit Repair & Monitoring

Business Credit Repair Services

North Shore Advisory, Inc. has been the leader in business and personal credit repair for over 30 years. We are one of the only companies to perfect a dependable approach business credit repair. Our business credit experts take the time-consuming task of credit repair off the hands of owners and executives so they can focus on running their business. Countless business owners from a variety of industries count on North Shore Advisory business credit experts to repair, build, and monitor their business credit reports.

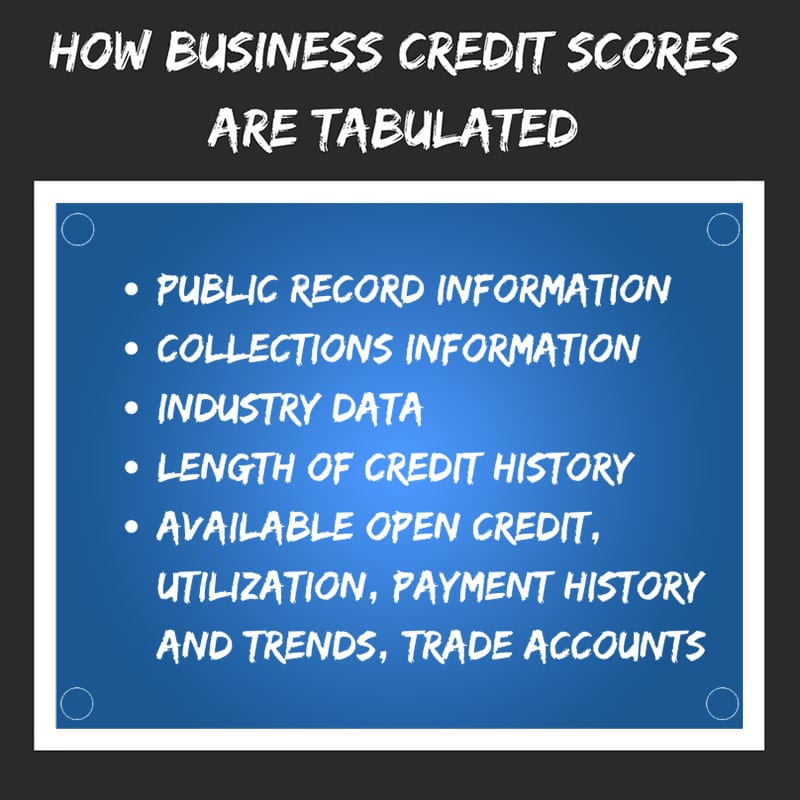

North Shore Advisory has company credit repair programs designed to fix, change, correct and delete information that is hurting the credit scores and indexes of your business. There are many credit scores and indexes associated with the business credit bureaus that can fluctuate for a variety of reasons. Potential accounts, partners, and even executive talent that is on the cusp of making a decision to work with your firm could turn away based on red flags reported to credit bureaus whether the information is accurate or not. Score and index threshold changes can be caused by something as small as a recent late payment from a vendor account or a high dollar collection account caused by damaged goods returned to the supplier with a resolution pending.

Your business may need credit repair, credit building, credit monitoring or a combination of the three.

Because most of our clients need to reflect consistent, stable credit scores, we work to repair, monitor, and update their credit on a daily basis. Our monitoring service provides our clients with the ease of knowing that our expert credit staff is watching and addressing situations immediately to avoid altering their scores/indexes causing risks to future and current business relationships.

Once we conduct an initial credit analysis we will be able to help you figure out which programs and services work best for your needs.

There are many reasons why your business credit might be reviewed

- Business loans

- SBA loans

- Factoring

- Commercial real estate

- Vendor payment terms / lines of credit

- Investor relationships

- Potential & existing partnerships

- Sourcing executive talent

- Supplier relationships

- Government bids

- Competitors looking to gain an advantage

- And more…

Whether you’re shopping for a business loan or you just want good payment terms through a new/existing vendor, business credit scores and reports will be used to predict your financial reputation and determine what kind of borrower you are. It’s important that business owners take the steps to understand, build, improve, and manage their business credit profiles.

Your company credit reports can be purchased at any time and for any reason, and the principal’s do not need to give approval or be informed of the pull.

Business Credit Repair

Many of our business credit clients have shown concern and discouragement in regard to repairing and building their credit profiles.

- Some business owners will make an effort to cut corners on costs wherever they can. We have come across clients who spent countless hours/days/months digging through the overwhelming content on Google, in an effort to repair and build credit on their own. Most of these clients have come to us after exhausting all their options with only a lot of wasted time and resources to show for it. Time that could have been spent creating more success for their company.

- So unfortunately, there is no “how-to guide” for repairing business credit, similarly to personal credit, it will depend on the information on each individual report, the judgments, liens, bankruptcies, and/or delinquencies weighing down the scores and the stability of the overall business. There are major differences between repairing business credit and repairing personal credit. Minimal laws and regulations govern the business credit reporting agencies. They are not required by law to give businesses information or address requests in a timely manner where personal credit bureaus are held to the laws of FCRA & its amendments.

- We have also come across clients who have submitted numerous requests to D&B, Experian, and Equifax asking for information to be removed. Many of them have gone months without any results or even a response from the bureaus.

- Similarly, to personal credit repair, when a business is looking to improve scores there is frequently credit repair needed to remove delinquent information on reports. But, due to the highly unregulated nature of business credit it is close too impossible to know how to fix incorrect or delinquent information without first reviewing reports with a business credit specialist. There are also counter intuitive rules that apply that cannot be guessed or found by the lay person.